Ultimi link in questa sezione

The Euro Area, Home Ownership And Unemployment

Andrew Watt recently published a comment entitled Detroit, Migration And Optimal Currency Areas here at the Social Europe Journal. I would like to complement his analysis.

In 1996, Andrew Oswalt first raised the idea that there is a possible link between high homeownership and high unemployment. Along with David Branchflower, Oswalt found in May of this year that (among other factors) higher homeownership reduces labour mobility, which has an adverse impact on employment. A related recent working paper by Jani-Petri Laamanen contains a useful summary of the literature. These two news articles also nicely summarize the possible link.

The case of Detroit is particularly interesting because Detroit had a very high rate of homeownership – the highest amongst the 20 major US metropolitan areas according to a 2010 study carried out by the New York Fed. Michigan historically had the highest rate of homeownership of the 50 US states during the post-war era. This high rate of homeownership may have constrained the ability of the economy to adjust.

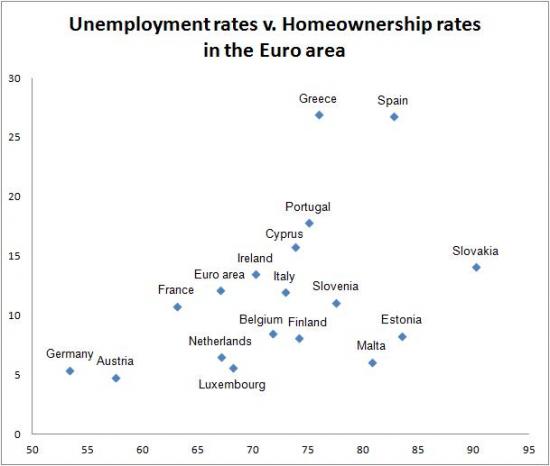

The data for the below chart compares Eurostat homeownership rates from 2011 (ilc_lvho02) with unemployment data from April of this year (une_rt_m):

In the Euro area, the countries with the lowest levels of homeownership (Austria and Germany) are also the countries with the lowest levels of unemployment. Spain is the most significant example of a country with a high level of unemployment and a high level of homeownership. The experience of many Spanish households is that they are stuck servicing onerous mortgages, which means they are also stuck in one physical location, which makes an adjustment even more complicated.