More On Wage Policy A La Draghi: Share And Share Alike?

In my last SE column (reprinted here) I criticised ECB President Draghi for basing policy recommendations on a comparison between productivity growth, measured in real terms (i.e. excluding the effects of inflation), and nominal wages (which are measured in current prices, and thus allow for inflation).

There is a simple way to visualise how wrong this is. Imagine for a moment that all countries would follow this rule. What would happen?

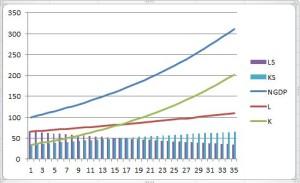

In the figure we start with an economy with annual output of 100. It is split between workers (L) who get two-thirds and capitalists (K) one third. (For the wonks: this is the adjusted wage/profit share at factor cost.) This is roughly the wage or labour share at the start of EMU. To keep it simple, assume that the labour force is constant (actually not so unreasonable for the ageing EMU). Productivity grows at 1.5% a year. The ECB, of course, sticks to its Treaty mandate and delivers 1.9% inflation a year. So nominal GDP grows at 3.4% a year: that’s the blue line at the top.

Now let nominal wages grow at the same rate as (real) productivity, as Mr. Draghi seems to have suggested, in his speech to Heads of State and Government, was a great idea. That’s the red line, L, which starts at 66 and increases rather flatly. One you have done that it is a fairly simple matter to calculate K, the income of capitalists: unsurprisingly it increases much faster, from its lower base (34). (Yes, some people draw both wage and profit income, but that’s not the issue here.)